This placement and subsequent SPP fully funds iTech’s exploration and resource development plans for both the newly acquired Reynolds Range Copper-Gold-Silver Project in the Northern Territory and the Company’s advanced Eyre Peninsula Graphite Project in South Australia.

The Reynolds Range Project is producing some exciting early results with rock chip of up to 182 g/t Au and copper and silver results still pending. The Scimitar Prospect has been identified as a short-term drill target with an exciting electromagnetic conductivity target beneath outcropping copper-gold and silver mineralisation, due to be drill tested in the coming months.— Managing Director Mike Schwarz

HIGHLIGHTS

- Successful completion of placement to raise $1.8 million at $0.071 (7.1 cents) per New Share

- Share Purchase Plan (SPP) to be offered to eligible investors, on the same terms, to raise up to a further $1 million with the option to take oversubscriptions

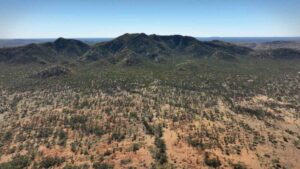

- Funding will be used to undertake exploration for copper, gold and silver at the Company’s newly acquired Reynolds Range Project, NT and develop the Company’s advanced graphite project on the Eyre Peninsula, SA

- Drilling of an advance copper-gold-silver target at the Scimitar Prospect is planned in coming months

- Further exploration planned around the recently announced rock chip results of up to 182 g/t Au

DETAILS

The A$1.8 million Placement and $1 million share purchase plan to existing eligible shareholders provide funding for iTech’s upcoming exploration programs. Funds raised, along with existing cash of $2.7 million (31 March 2024), will be principally used for:

- Reynolds Range: Scimitar Prospect Cu-Au-Ag Diamond Drilling

- Reynolds Range: Regional Cu-Au-Ag and Li exploration and drilling;

- Lacroma and Sugarloaf metallurgy;

- Graphite Pilot Plant scoping study; and

- Working capital

The Placement of A$1.8 million was completed under ASX Listing Rule 7.1 (13,159,962 New Shares) and ASX Listing Rule 7.1A (12,228,356 New Shares).

The New Shares under the Placement will be issued at A$0.071 per New Share (Placement Price), which represents:

- A 29.0% discount to the last close price on 12 July 2024 of A$0.10;

- A 19.9% discount to the 5-day volume weighted average price of A$0.089; and

- A 3.8% premium to the 15-day volume weighted average price of A$0.068

Share Purchase Plan (SPP)

iTech’s existing eligible shareholders, being those shareholders that are residents in Australia or New Zealand that held iTech shares as at 7:00pm (AEST) on Tuesday, 16 July 2024, will be invited to participate in the SPP at the same issue price as the Placement (A$0.071 per share). The SPP will provide eligible shareholders the opportunity to increase their holding by up to A$30,000 without incurring any brokerage or transaction costs.

Further information regarding the SPP (including terms and conditions of the SPP) will be provided to eligible shareholders in the SPP offer booklet, which will be made available to eligible shareholders shortly. Eligible shareholders wishing to participate in the SPP will need to apply in accordance with the instructions in the SPP offer booklet. Participation in the SPP is optional.

RECENT NEWS FROM THE INVESTOR CENTRE

Ask iTech: Graphite Progress and Bulk Samples

EXPANDED GOLD PROSPECTIVITY AT THE SABRE PROSPECT