Antimony

The Growing Demand for a Vital Mineral

Key Takeaways

- Critical & In Demand – Essential for defense, electronics, and energy storage, with rising supply risks

- Supply Threat – China dominates production, with export restrictions worsening shortages

- Australia’s Opportunity – iTech Minerals and other explorers have an opportunity to close the supply gap

What is Antimony?

The Most Important Mineral You’ve Never Heard Of

As far back as 4000 BCE, men and women in ancient Iraq and Egypt used kohl, a thick black ointment made from antimony sulfide, to paint around their eyes.

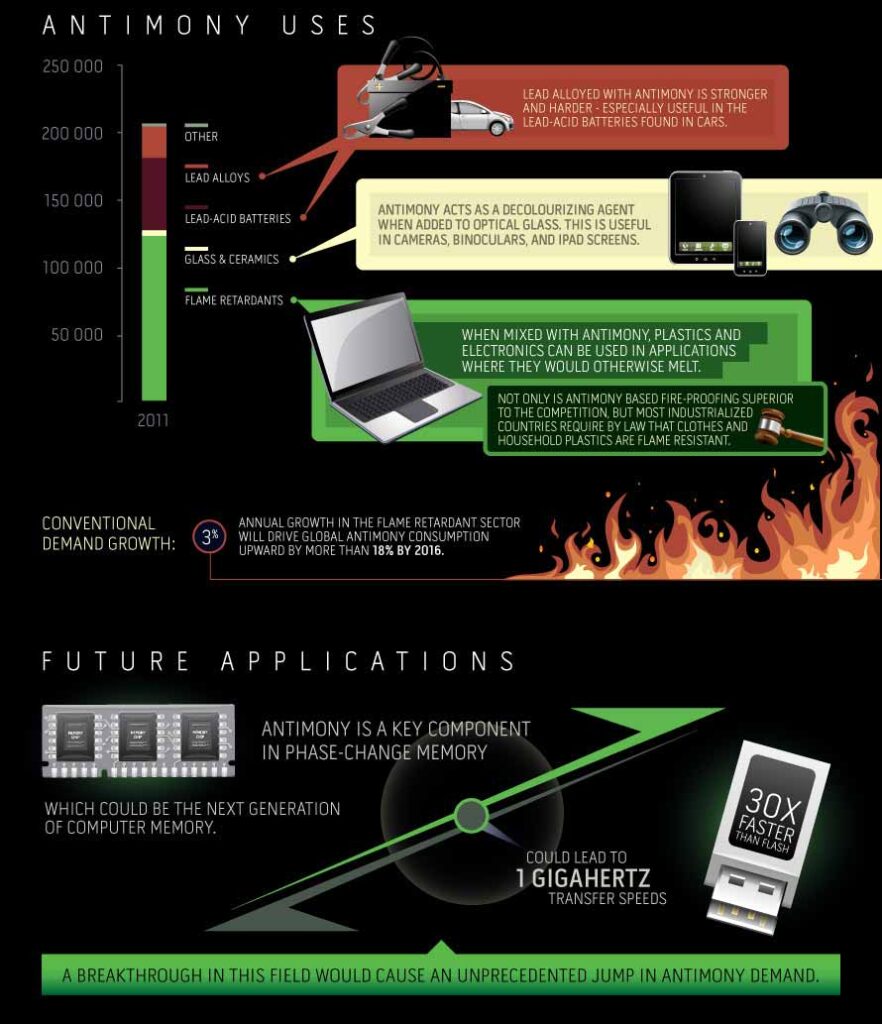

While today we recognise antimony as a toxic element in the arsenic group, it remains critically important—albeit for very different reasons. The brittle, silvery-white, and lustrous metalloid is primarily used as a hardening agent for lead, accounting for about one-third of global consumption. It is vital in the production of lead-acid batteries, semiconductors, and military applications such as armor and ammunition. Beyond lead alloys, antimony is crucial in plastic catalysts, infrared detectors, glass and ceramics manufacturing, and as an additive to enhance strength and durability.

Source: Visual Capitalist

Growing Supply Risk

Australia’s Opportunity to Bridge the Gap

To secure future supply and reduce reliance on a single dominant producer, discovering new antimony sources has never been more crucial. While Australia is not a major producer today, the country is geologically well-positioned, with known antimony occurrences, particularly in regions where it is found alongside gold mineralisation.

Recognising this opportunity, iTech Minerals is actively exploring for antimony at its Reynolds Range Project. The region is historically known for its gold potential, and because antimony is often found in association with gold, it presents a promising target for new discoveries.

By developing a domestic supply of antimony, Australia could play a key role in stabilising global supply chains, reducing reliance on overseas sources, and supporting the industries that depend on this critical mineral.

Despite its proven mineral potential, vast areas of the Aileron Province remain under-explored, leaving room for significant discoveries.

iTech Minerals sees the potential for applying new exploration techniques to unlock previously overlooked deposits, further solidifying the region’s importance in the search for new copper resources.

TAKE A DEEP DIVE INTO ANTIMONY

Due to global price increases for antimony, we received a number of questions from investors regarding the potential for this mineral at the Reynolds Range Project, as well as the recent top-up placement.

In this 4-minute ‘Ask iTech’ MD Mike Schwarz discusses these questions.