THE GRAPHITE STORY

Why iTech is investing in a building block

of the future.

Table of Contents

Graphite’s exceptional electrical conductivity, resistance to corrosion, and impressive strength at high temperatures has always made it an indispensable element across the steel, automotive, aircraft, electronics, energy and nuclear industries.

But as the appetite for new technologies such as electric vehicles, smart phones and laptops soars, high-quality refined graphite is increasingly in demand because it is…

...a key ingredient in the lithium-ion batteries that power them.

In 2022, for the first time, the demand for graphite in battery anodes surpassed all other uses combined. This underscores a fundamental change in the graphite market dynamics.

Because of the ever increasing appetite for graphite from the battery sector, many analysts are now predicting that the supply will not be able to meet demand over the coming decades.

A closer look at the output of current and likely sources of natural flake graphite and the expected base case of demand.

Source: Benchmark Minerals

The graphite deficit

Around 800,000 tonnes of graphite crystalline flakes are sold annually and the supply is currently meeting the world’s needs. However, the low level of investment in new projects means the voracious appetite of battery manufacturers will soon outpace the ability of the existing natural graphite producers to keep up.

To meet the needs of the currently announced investments by battery and car manufacturers, graphite production will need to double over the next five years.

According to leading forecaster Benchmark Minerals, over the next decade the world’s graphite production will need to ramp up significantly, with up to…

...93 new graphite mines required.

And there is a strong economic case for investing in new graphite projects. Analysts have estimated that the total market for batteries could reach as much as US$400 billion by 2030. With the cost of producing the lithium-ion battery’s anode making up around 30% of the entire manufacturing cost and up to half of that amount going toward the cost of materials, graphite producers could end up with a 15% slice of the entire battery market’s manufacturing outlay.

Electric Vehicles driving demand

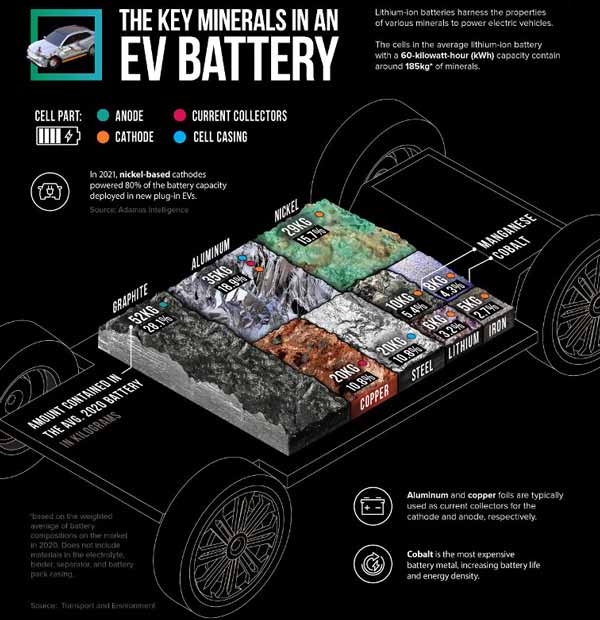

When considering demand most of the focus is on the fact that a highly purified and processed form of graphite, known as spherical graphite, is one of five materials that is critical to manufacture batteries for electric vehicles (EVs), along with lithium, cobalt, nickel, and manganese. Due to the fact it enables high conductivity, performance and charge capacity, graphite serves as the primary anode material (the battery’s negative terminal) in 95 percent of all lithium-ion batteries.

Source: Visual Capitalist

The CEO of the world’s best-selling Tesla EVs, Elon Musk famously says that lithium-ion batteries should instead be called nickel-graphite batteries because they need up to 60 kilograms of graphite, which is over 10 times more than the amount of lithium required.

There’s a little bit of lithium in there, but it’s like the salt on the salad.

Elon Musk

And the battery market is continuing to grow at an incredible pace.

The number of gigafactories producing batteries globally is set to almost double from to 240 to 400 by 2030 – with many of the new projects planned in Europe and the USA. In North America, just taking into account the projects that have been announced or are under-construction, the battery manufacturing capacity is set to grow ten fold by 2028.

This will require a corresponding amount of growth in the upstream supply chain.

The bigger story

When you scratch the surface there are a number of geopolitical factors that have the potential to reshape the graphite market over the coming decades.

As the world shifts towards a clean energy future and new technology becomes ingrained in every part of our lives, the supply chain of a number of minerals has becoming a national security concern.

Graphite has now been designated as a 'critical mineral' by multiple governments, including the USA, UK, Japan, Canada and Australia.

Globally, governments are actively working on strategies to prioritise critical minerals like graphite, aiming to boost domestic manufacturing and guarantee a stable supply.

These include the Australian Government’s $4 billion Critical Minerals Facility that was established to support key infrastructure projects like Renascor’s Sivior Graphite Deposit in South Australia, and the Inflation Reduction Act, through which the US government is using tax incentives to reduce manufacturer’s reliance on China and forcing them to ‘onshore’ or ‘friend-shore’ their supply chains.

Source: Benchmark Minerals

China’s recent introduction of export permits which restrict trade on graphite has heightened concerns for potential graphite shortages in the future and encouraged more interest in the exploration and investment into non-Chinese resources.

China's dominance

China has long been the main producer and exporter of graphite globally, with an approximate 70% of the market share.

When it comes to batteries, that dominance has become a stranglehold. China now controls over 99% of the world’s spherical graphite processing market.

What does this mean for graphite prices?

As these factors begin to influence the global graphite market, there is potential for a dramatic step change in the price.

This first indication of this has been the development of a two-tiered pricing system that is now being reported by Benchmark Minerals. This system differentiates between the standard global graphite price and a premium price for natural graphite sourced outside China.

The graphite price

Is synthetic graphite the solution?

Probably not.

Although graphite does occur naturally, most of the world’s supply is actually manmade. Forecasts that predict graphite shortages take into account the fact we will have to boost the production of synthetic graphite. There are a number of reasons why we can’t just make enough to meet the skyrocketing demand.

Synthetic graphite is produced by heating petroleum coke or coal tar-pitch in an electric furnace. This process can be more than four times more carbon-intensive than refining natural flake graphite. This means the cost is closely linked to energy prices and it can make producing synthetic graphite twice or even three times more expensive than natural graphite if energy prices rise.

Consumers are also becoming more aware of the environmental and ethical issues of the products they buy. While natural and synthetic graphite are both options for making anode material for lithium-ion batteries, the importance of using ethical and low-carbon raw materials is growing. As a result, battery manufacturers are turning to natural graphite because it is a more sustainable option.

Although natural graphite has superior Environmental, Social and Governance (ESG) credentials, it is not without its own ESG concerns. In particular, the purification process can use high quantities of reagents such as sodium hydroxide and hydrofluoric acid. With increased interest and demand, producers are now developing new ways to process natural graphite that use more environmentally friendly techniques to liberate and refine the graphite.

iTech's mission to produce 'Green Graphite'

for the 'Green Energy' revolution

To be suitable for the battery market, graphite flakes must be refined to 99.5% purity and ground up into a specialised form known as spherical graphite.

This process presents two major challenges for producers.

Firstly, grinding the natural flakes into the tiny balls requires a large amount of electricity.

Secondly, the current process for removing the final impurities from this spherical graphite includes using strong chemicals like Hydrofluoric acid. This acid is extremely effective because it dissolves just about anything – except for graphite. It’s also incredibly toxic and has to be neutralised and disposed of after every use, posing serious environmental issues.

iTech Minerals is currently working on a plan to use the abundance of renewable energy options in close proximity to the Campoona Graphite Deposit to power the project, as well as undertaking a research project with industry leaders ANZAPLAN to develop a new process for purifying the graphite ore without the need for these chemicals.

This would result in a potentially cheaper, premium, carbon-neutral, acid-free graphite product.

Read more about this test work here:

What is natural graphite?

When carbon in the ground is subjected to extreme heat and pressure over a long period of time it turns into one of three minerals; diamond, coal or graphite.

Graphite is present in the Earth’s crust and in the upper mantle, needing pressures of approximately 75,000 pounds per square inch and temperatures of over 750 degrees celsius to be produced. It is found in three different forms;

- High-grade metamorphic rocks

- Crystalline flakes in veins or fractures

- Amorphous graphite in thermally metamorphosed coal deposits

Most exploration endeavours target crystalline flake deposits located near the surface because they can be extracted using open pit methods, which are more economical compared to the underground mining methods needed for vein graphite extraction.

Once it has been extracted, graphite ore is processed and refined to make specialised products including;

• Spherical Graphite – also referred to as battery-grade graphite. It is used in the production of anodes in most common battery technologies and is made by refining flake graphite concentrate into ultra-high purity (>99.95% TGC), microscopic spheres (15 to 5 microns).

• Graphene – made by breaking down graphite flakes into individual, one atom thick sheets of carbon.

Graphene - a game changer?

- Graphene is the world’s first 2D material and is one million times thinner than the diameter of a single human hair.

- Graphene is the strongest material discovered to date. It is 10x lighter and over 100x stronger than steel.

- Graphene can be stretched by an amazing 25% percent without breaking.

- Graphene is transparent.

- Graphene is better at carrying heat than many metals — including silver and copper.

- Graphene conducts electricity more efficiently than copper. In fact, it is almost as good as some superconductors. Importantly, unlike superconductors, which need to be cooled to low temperatures, graphene’s exceptional conductivity works even at room temperature.

Graphene is now being used to develop previously impossible technologies in the transport, electronics, energy, defence, desalination, and medical industries, with new applications still emerging.

Scientists are still dreaming up uses for this strong, light, transparent and relatively inexpensive material that can conduct electricity. It is currently being heavily researched in a number of fields including transport, electronics, energy, defence, desalination and medicine.

Imagine a smartphone that can be charged in seconds and rolled up like a newspaper, lightweight wearable sensors which can be used to monitor patients in hospitals, stronger, rust-free materials that are used to make cars and planes, or packaging that can keep food and water cleaner for longer. Graphene may be the key a huge range of future technologies.

Why iTech Minerals?

iTech owns 100% of the Eyre Peninsula Graphite Project (formerly the Campoona Project), which is a significantly de-risked, advanced development opportunity, in the heart of an emerging graphite hotspot, that is set to capitalise on the growing appetite for graphite.

The project has a Global Mineral Resource of 35.2 million tonnes at 6.0% TGC across a number of deposits on the Eyre Peninsula, South Australia. iTech has a mining lease for the Campoona Deposit and two licences for the processing of graphite and the transport of processing water from the nearby bore field.

iTech has conducted extensive metallurgical test work on samples form the project and shown recovery rates of up to 95% for producing 94% Graphite concentrate. It has also shown that the Graphite from the Eyre Peninsula Deposit is suitable for the battery markets.

Latest News From The Lacroma Project

Ask iTech: Graphite Progress and Bulk Samples

Ask iTech: The Long-Term Graphite Strategy Explained