LITHIUM

An essential, highly sought-after commodity driving the clean energy revolution

Key Takeaways

- Lithium based batteries play a pivotal role in reducing carbon emissions due to their long life cycle and high efficiency.

- Global efforts to decarbonise the transportation industry is projected to boost lithium demand by a staggering 26 times by the year 2050.

- Existing lithium mines and mines under construction are projected to meet only half of global requirements for the clean energy transition.

- Discovering new lithium deposits remains a key challenge in the clean energy future.

- Western countries are concerned that a high level of dependence on Chinese-made lithium products may create energy security risks.

- Western countries are moving to build their own supply chains, sparking what is called an “arms race” in the battery sector.

What is Lithium?

The Lithium-ion Battery Advantage:

• Lighter weight

• Longer ranges

• Faster charging times

• Superior cycles of charging and discharging

• Extended lifespan

Powering transport electrification

As the world races towards a clean energy future and battery manufacturing ramps up globally, lithium-ion (Li-ion) batteries are at the heart of the Electric Vehicle (EV) revolution. EVs and battery storage producers now represent the largest demand for lithium, accounting for 75% of the world’s consumption.

Because Li-ion battery technology is able to store a lot of energy in a small amount of mass, the launch of the high-energy-density technology in the 1990s is seen as having paved the way for a fossil fuel-free economy.

Increasingly, cars, buses, and boats are powered by Li-ion batteries, replacing carbon heavy internal combustion engine-based propulsion systems.

The EV market demand for lithium alone is projected to increase 26-times by 2050 and by 2030 EVs will represent more than 60 per cent of vehicles sold globally.

The Two Key Factors Driving Demand

Climate Targets

In order to meet the climate goals of world governments, analysts estimate that existing lithium mines and projects under construction will meet only about half of projected requirements.

Hannah Ritchie, a data scientist at Oxford University, examined whether lithium scarcity could impact the world’s future green energy plans. She concluded that while there is enough lithium supply for the foreseeable future, there is not enough production to keep up with demand.

In 2022, the world produced 113,000 tonnes of lithium. But data from the International Energy Agency (IEA) shows that an electrified economy in 2030 will likely need anywhere from 250,000 to 450,000 tonnes of lithium.

Battery Production

The battery market is continuing to grow at an incredible pace.

The number of gigafactories producing batteries globally is set to almost double from 240 to 400 by 2030 – with many of the new projects planned in Europe and the USA. In North America, just taking into account the projects that have been announced or are under construction, the battery manufacturing capacity is set to grow tenfold by 2028.

This will require a corresponding amount of growth in the upstream supply chain.

Discovering new lithium deposits as well as improving methods to extract and utilise the precious resource sustainably is now more important than ever. Recent analysis by the IEA suggests around 50 new lithium mines are needed to meet carbon emissions goals by 2030.

Where in the World is Lithium?

Meeting the rising demand for lithium by ensuring an adequate supply is a major global challenge.

According to the U.S. Geological Survey, there are 88 million tonnes of lithium on earth. But it is a comparatively rare element, found in very low concentrations in rocks and brines, as well as in trace amount in plants, plankton, and invertebrates.

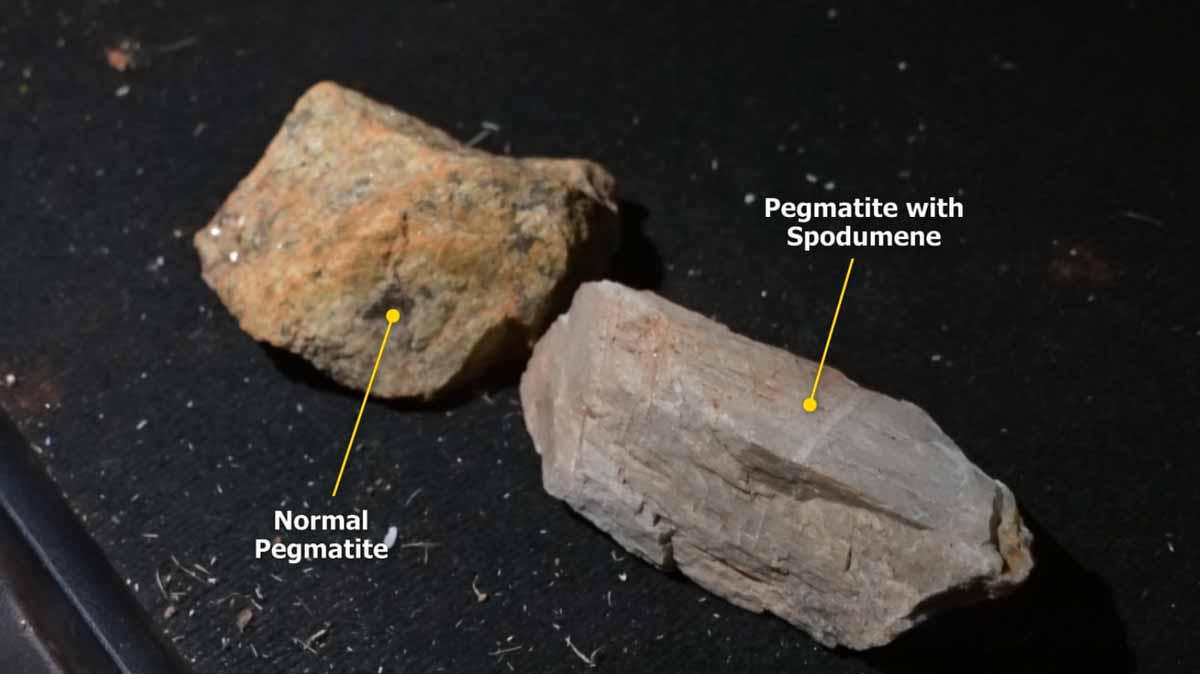

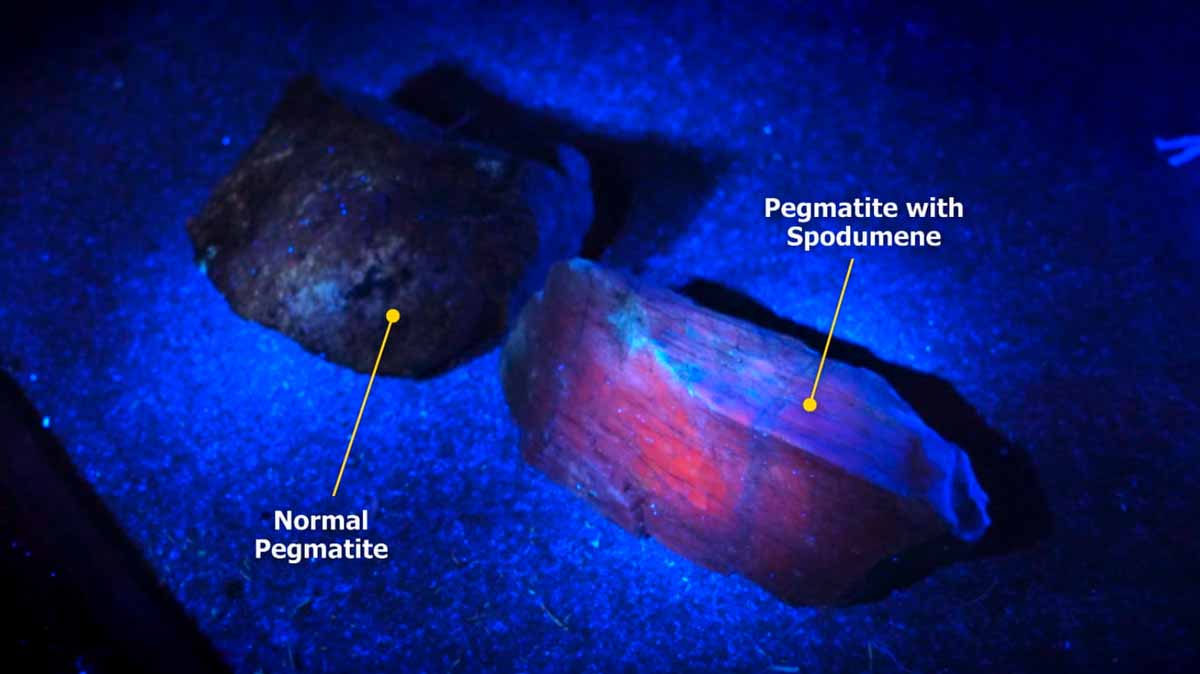

More than half of the world’s lithium is extracted from spodumene, a mineral found in hard rock deposits located in regions such as Western Australia, Canada and the USA. Lithium is also sourced from salty brine that is pumped directly from the earth, particularly in areas of Chile and Argentina.

The benefit of spodumene over brine sources for lithium extraction lies in its greater lithium concentration and more established processing methods.

IMAGE: Spodumene is a mineral found in hard rock deposits that boasts a high concentration of lithium. It is often identified in the field using ultraviolet light.

Use the slider to see an example from iTechs’ Reynolds Range Project